Tariffs + Trade Wars

- Additional China: 10% effective 2/4/25 + 10% effective 3/4/25.

- Mexico + Canada: 25% effective 3/4/25, exemption for USMCA eligible products.

- Steel + Aluminum: 25% effective 3/12/25.

- Reciprocal Tariffs: 90 Day Delay, implementation expected 7/9/25.

- Reciprocal Tariffs – China: 90 Day Delay, implementation expected 8/12/25.

- Universal Tariff: 10% baseline tariff on all countries (if no effective reciprocal)

- China banned export of critical minerals (gallium, germanium and antimony) to US on 12/3/24.

- Gallium and geranium are used in semiconductors, and this could cause increased pricing and lead time.

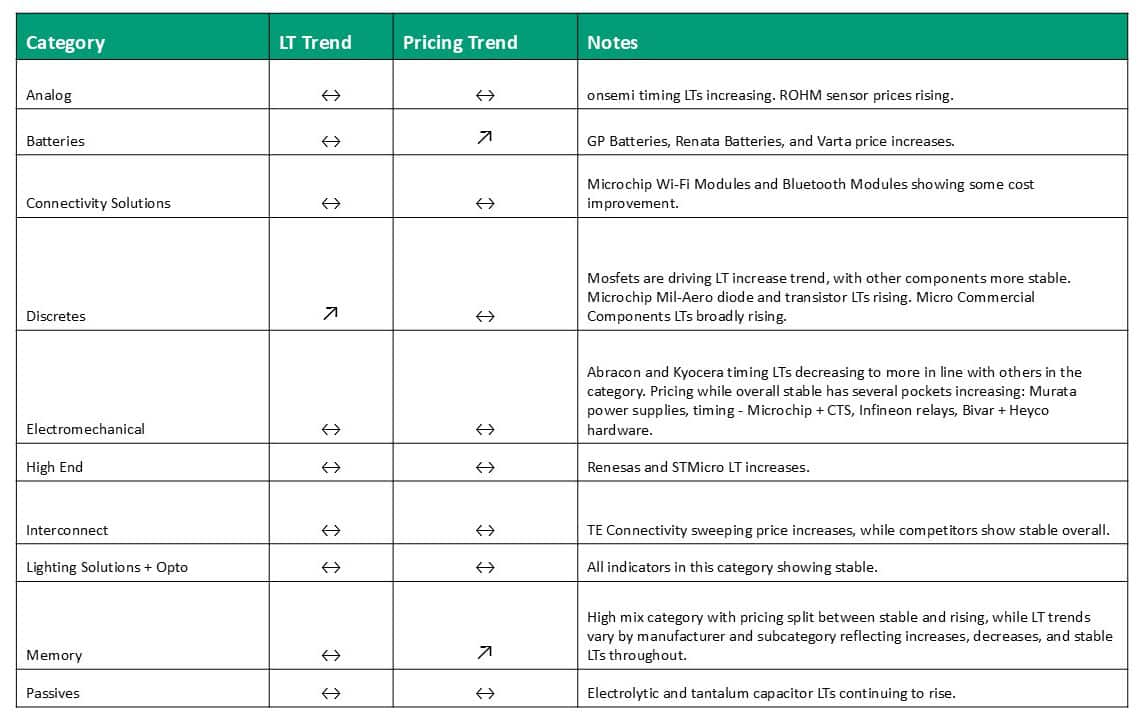

Market Trends

General Updates:

- Lead Times in general are stable at all-time lows, but low forecast visibility is starting to drive lower stock levels in the market, making full factory LTs more relevant.

- Pricing is generally stable with pockets of both increases and decreases out there.